.

.

.

This is not a criticism of President Vladimir Putin. He has been in power for 18 years more or less, and he has skillfully avoided WWIII by the Jewish Neocons, who take their orders from the Rothschilds of London.

Not surprisingly anti-Russia hysteria is the greatest in the UK, followed by the USA (Poland)

The Jewish Neocons imagine that Russia is just another AFRICAN country like the DRC, ready and waiting to be divided and carved up with her $80 trillion worth of minerals under MOTHER RUSSIA. The sacred Russia where the Iranian races first evolved 5000 years ago.

The GLOBALIST Jew wishes to steal FROM Russia, using the

1. 500,000 Jews STILL in Russia, euphemistically known as 'LIBERALS' либеральный in the Russian language, or 'Atlanticists'

2. Colour coded George Soros revolution using the American embassy, American NGO's in Russia and the NED.

3. Islamist terrorism via NATO Turkey mostly, and Saudi Arabia.

4. NATO/USA military bases around Russia.

5. Sanctions.

http://123movie.sc/watch/RGbA12xY-the-siege-of-jadotville.html

This is why it was so important Russia intervened in SYRIA

(i) To demonstrate to the Jewish Neocons how Russia really fights with equipment that in many cases outperform the Americans.

(ii) Deal with ISIS, before its victory in Syria, then to IRAN, then against Russia.

This was the advice I approximately gave to President Putin in an email to him in 2006.

To President George Bush I sent faxes, requesting he avoid a military confrontation with Iran (2004--2008.) and Pakistan (2001)

To President Obama, I wrote with an American colleague about the dangers of a huge security state in 2009.

I was right in all cases.

After the collapse of the Soviet economy by the Jews and specifically the thoroughly corrupt British agent Pizza Gorbachov.

President of the Russian Central Bank, Ms. Elvira Nabullina is an ethnic Tartar, Muslim and a WOMAN. Multi-culturalism outside of Israel is a GLOBALIST Jewish weapon to weaken societies so that they obey Rothschilds Central bank dictates, from London (The city where all the dirty Russian oligarchs go after looting Russia).

I would prefer an Indo-European MAN, who is ethnically Russian and an Orthodox Christian, and who has not been 'educated' by the Chicago School of Economics or Harvard Business School to be the President of the Russian Central Bank. A Russian MAN not too taller than President Putin, who is an avowed Eurasian nationalist and a supporter of 'Demand-side' Economics. __________________________________________

Russia's Clueless Central Bank Is Starving the Economy With Crazy High Interest Rates

"At this point Russia’s biggest enemies exist not in the United States where the ham-fisted machinations of Cold War simpletons like John McCain and Bill Kristol still dominate policy think tanks, it’s the fifth columnists within Russia herself."

By Tom Luongo at Russia Insider.

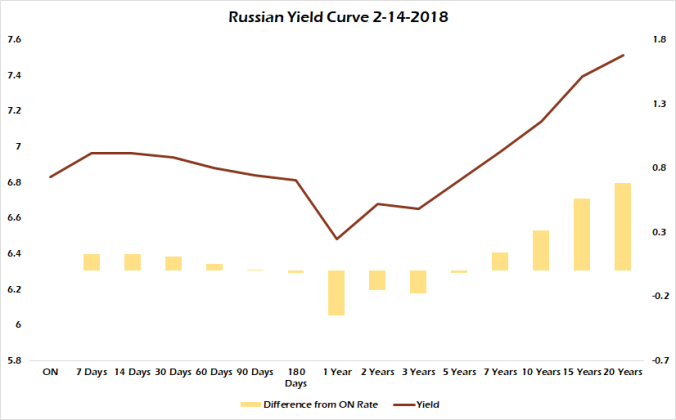

I’ve been critical of the Bank of Russia’s slow-rolling their interest rate cuts for more than a year now. This ultra-conservative approach has worked to also slow the growth of the domestic Russian credit cycle, keeping borrowing costs well above the demand for Russian debt.

Last Friday the bank lowered its benchmark lending rate 25 basis points to 7.50%.

And in a completely counter-intuitive turn of events, the ruble strengthened as a result.

But what is so noteworthy is how commonplace that reaction from the ruble to a central bank rate cut is.

It tells you just how starved the Russian economy is for its own currency. The ruble is supposed to drop on increased supply, which is what lower rates imply. When, in fact, the opposite occurred. Demand for the ruble rose to because borrowing costs were lower.

This speaks to just how much the Bank of Russia’s policies are holding back what should be a much more robust expansion at this point.

Overly tight interest rates are just as bad as overly accommodative rates. They both bias economic investment along the wrong points in the structure of production, by mis-pricing risk.

Usually Austrian Business Cycle Theory is applied to western Central Banking models to criticize Keynesian-style counter-cyclical policy which lowers interest rates in the face of falling aggregate demand.

The problem with this analysis, and Keynesian/Mixed-Monetary Theory economics in general, is simply that there is no such thing as aggregate demand.

Demand for goods and services is unique to the individual markets.

And as such, so is the risk-tolerance of the investors in said markets. So, there really is no one interest rate for an economy. It’s why all central banking schemes will eventually end up in the gutter.

The decisions to expand or contract output in any particular markets is dependent on the cost of capital. And the cost of capital is dependent on the cost of money, i.e. the rate of interest to borrow.

More complicated projects with longer rates of return require lower interest rates. Whereas shorter-term projects can absorb higher interest rates because the payback period is itself shorter. And the borrowed funds function more as activation energy to kickstart a project rather than the lifeblood the project needs to get to completion and begin paying back investors.

So, while I applaud the Bank of Russia for being niggardly with easy loan capital to ensure this current expansion is built on a solid footing with a vast pool of real savings, I also feel that the rates it is charging are well above what the market is demanding.

In other words the Bank of Russia is still looking at the Russian economy as too immature to take on bigger projects and the market is saying otherwise. Why?

Two Steps Forward, One Rate Cut Back

The proof is in the structure of the Russian yield curve. For loans in the interbank market, which are less than one-year in duration, the yield curve is 1) still inverted with higher yields occurring at shorter time frames and 2) higher than Russian Sovereign Bonds of greater than seven-years in maturity.

It’s why industrial GDP output has been so slow to find its feet and begin spinning up great returns. Big purchases like industrial equipment are impossible to finance at 10+% rates.

So are mortgages. The latest numbers out of the Russian auto market saw a 31% year over year increase in January.

The implication of this chart is that Bank of Russia President Elvira Nabullina has room to cut rates right now by another 75 basis points and it wouldn’t harm anything except current growth.

With the number of people within President Putin’s government that still want good relations with the West at any costs, most especially that of Russians themselves, this policy is suspect as it continues to keep Russia’s economy weaker than it needs to be.

But with the Fed resolutely moving forward with its balance sheet normalization and commensurate higher rates, the demand for non-ruble denominated credit in Russia should be abating.

This is one of the knock-on effects of incredibly tight monetary policy, it subsidizes domestic foreign-currency lending based on the spread between central bank policy rates.

With the U.S. and ECB at the zero-bound it was hard to get Russians to borrow in rubles, when dollars and euros were plentiful in Russian banks and the rates far lower. Now those spreads are tightening quickly but they are still quite high, more than 3.5% on 10 year debt (U.S. vs. Russia).

This is why Nabullina needed to move quicker with rate cuts, in my opinion. It was keeping the market for U.S. dollar and euro debt robust while Putin and his economic advisors were trying to improve the ruble’s profile as a lending currency.

This is part of the reason why Putin fired his long-time ally Alexei Kudrin in 2015 and brought in Stolypin Group leader Sergei Glazyev. Glazyev has been outspoken in his criticism of Nabullina’s overly-tight monetary policy.

While Glazyev wanted much lower rates much faster, Nabullina stubbornly stuck to her inflation-targetting approach. But she’s way past her mark. And as such, now needs to aggressively cut rates below 7%, if not all the way to 6%.

Mixed Monetary Signals

There have always been questions surrounding people like Nabullina and Prime Minister Dimitri Medvedev and their true loyalties for years. I believe the past few years of increasingly belligerent U.S. policy make those fears overblown. As in, Putin has more allies now than just three years ago.

But, it’s hard to overcome your training.

Nabullina is cautious as is Putin. She was trained in the West, so IMF-style austerity dominates the thinking within the Bank of Russia. There are plenty of other officials within the Bank of Russia and the Ministry of Finance who are opposed to Russia’s chosen paths for financial independence. Though I no longer consider Nabullina among them.

I talked about some of the implications of this in a recent post regarding draft Ministry of Finance rules on Bitcoin and cryptocurrencies in general.

It finally took Putin demanding they put a draft together by the end of this year to get something from them. Deputy Finance Minister Alexei Mosieev has been very hostile to Bitcoin and the legislation is a reflection of this.And, for the life of me, I have to wonder what he’s thinking when it is obvious that Putin wanted something far more progressive than this backwards looking bill.For all of the talk about how Putin runs Russia with an iron fist for his own enrichment, it was he who pushed for regulations and legislation to be drafted. And for the MoF to come back with this along with the Bank of Russia’s blessing is telling.I’ve always heard that it is the Russian banking system and the politicians connected to it that are the real Fifth Column within Russia that Putin has yet to get under full control. The Bank of Russia’s adherence to IMF-style austerity in the wake of the ruble crisis in 2014 has made this clear.

Now we have this announcement this morning that Russian banks are prepared to function if cut off from the global interbank communications market, the markets are getting mixed signals.

Russia’s Deputy Prime Minister just declared its financial independence from the U.S.-controlled SWIFT network. They are the first country to officially do it, though China has its own system.

It’s not like SWIFT is that hard to implement. It’s a protocol. It’s software. The formatting of the information is public knowledge. Reverse engineering a protocol to be compatible with SWIFT transfer numbers shouldn’t have taken four years to implement if the people in charge of the project were amenable to it.

Just like it shouldn’t have taken the Ministry of Finance three years to put together a draft cryptocurrency bill either. But it did.

At this point Russia’s biggest enemies exist not in the United States where the ham-fisted machinations of Cold War simpletons like John McCain and Bill Kristol still dominate policy think tanks, it’s the fifth columnists within Russia herself.

It seems the changes are happening despite the endless knuckle-dragging. Trump is fighting the same battle here at home. It’s a war against the Bureaucracy. His budget proposal is the next shot across that bow; looking to streamline all of the cabinet departments to realign the spending.

But, it’s more than that. It puts the bureaucracy on notice that, like it or not, change is coming. Just like Putin’s message to his Atlanticist back-benchers, adapt or be replaced.